Is your car properly insured? - Chapter 1 : Windscreen Insurance Cover

Have you ever seen the windscreen of a vehicle cracked or shattered but the owner doesn’t seem intent on repairing or replacing it? If yes, then the vehicle probably does not have windscreen coverage. As the repairing and replacing cost of the windscreen is costly, therefore some of the owners will just ignore it if the crack is minor, however a broken or cracked windscreen may affect the driver's vision and it shouldn’t be practiced among drivers as it may jeopardize themselves and other road users safety on the road.

A common cause of cracked or shattered windscreen is the minuscule of flying debris such as pebbles and stones that hit on your windscreen or bounce off other vehicles causing the windscreen to crack. Regardless if you are a careful driver or not, it is unpredictable and the windscreen damage is inevitable. Therefore, having a valid and comprehensive windscreen coverage is important in avoiding hefty windscreen repair or replacement bills. However, there’s a catch: most of the car owners in Malaysia are not aware of the fact that the windscreen claiming will forfeit their NCD rate and end up costing them more money.

Windscreen insurance is an additional coverage to be added on top of your car insurance policy, this additional coverage will cover the cost of your windscreen replacement or repair, WITHOUT affecting your No Claim Discount (NCD). The form of coverage includes the front and back windscreen, all windows and sunroof glass window. With windscreen insurance, you can take your car directly to a panel shop for free repair or replacement as it will be covered under your windscreen insurance policy. In order to remain your NCD rate, you are only eligible to claim the windscreen add-on coverage once a year.

So how much will it cost if you would like to add-on the additional coverage for your windscreen? The additional insurance premium that you need to pay is only 15% of the amount insured for your windscreen. For instance, if the windscreen is RM1000, then you will only have to pay RM150 yearly on top of your insurance premium to get your windscreen protected and at the same time retain your NCD rate.

If you claim the windscreen for repair or replace without windscreen coverage, then you will lose your NCD. Drivers should keep in mind that their NCD will return to 0%, which means you lose your accumulated discount and need to pay the full amount of insurance premium the following year. Your wallet will undoubtedly suffer as a result of this. On the other hand, if you have windscreen coverage, you could still keep your NCD even after you claim for repair or replacement. For instance, if your NCD is 55%, you could still enjoy the same NCD rate the following year.

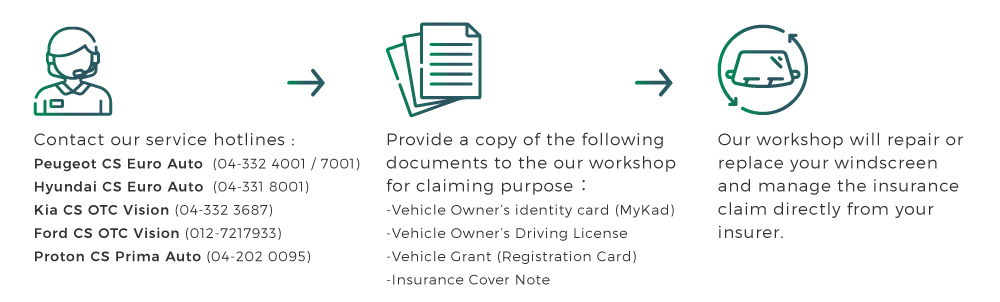

Get your windscreen insurance with us now !

It’s crucial for all drivers to get windscreen coverage as it might end up costing you hundreds or thousands of dollars when repair or replacement is needed. Why pay more if you can get coverage from your insurer just with a lower premium with great benefits. So save money and consider adding a windscreen coverage to your comprehensive insurance policy for a long run and keep your NCD for more discount. Simply contact us at 012-473 3001 or 016-875 6001 for quotations now. It’s fast and easy!